Article

The Growing Role of Nearshoring and Reshoring in Global Supply Chains

Anamika Mishra

[Sub Editor]

Anamika Mishra

[Sub Editor]

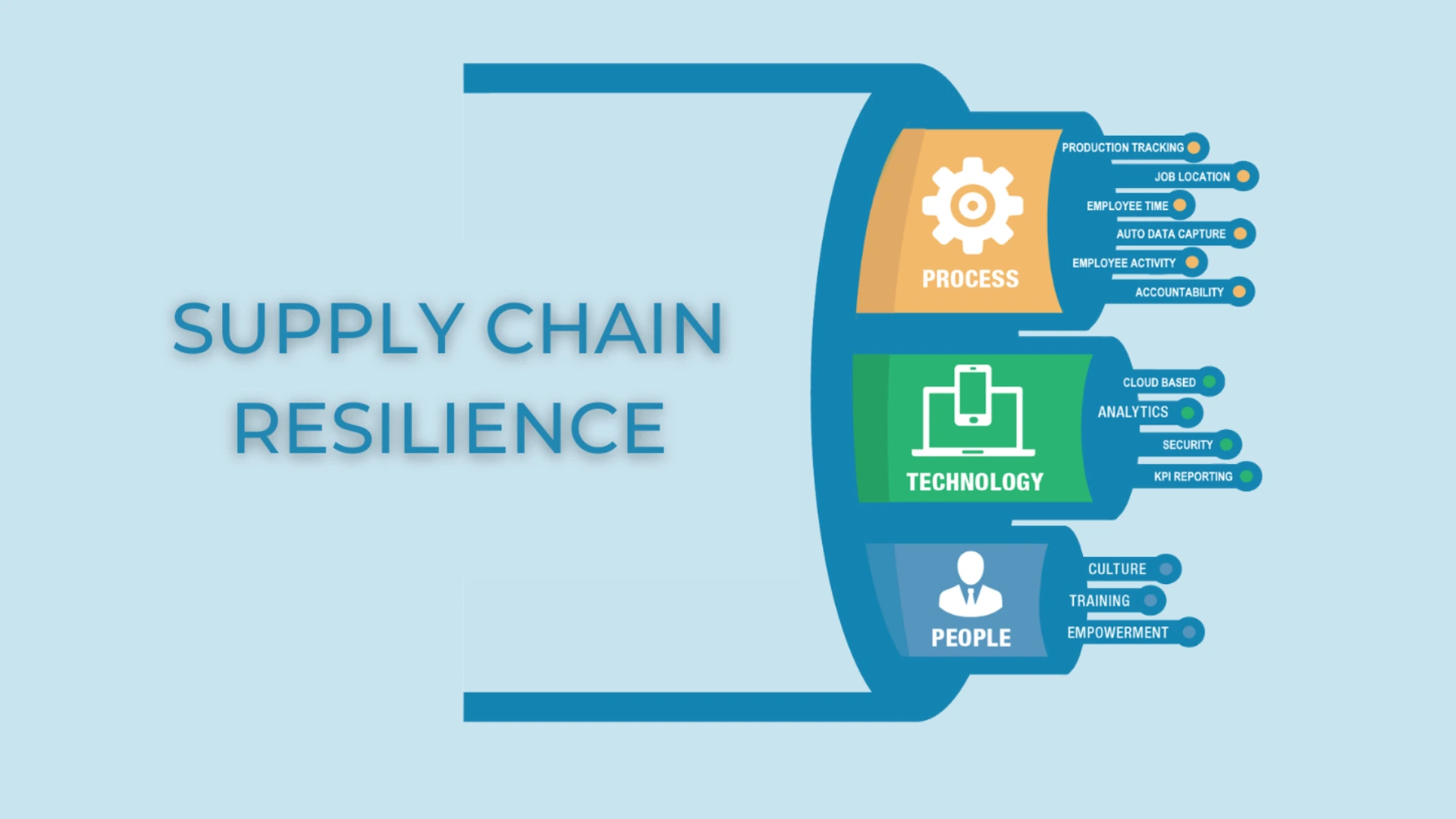

In fact, global supply chains already provide a very different model from the one they carried today. It would soon begin to pose a major challenge to offshoring, the traditional manner in which most production was moved overseas. Under pressure to re-organize productivity in response to geopolitical stability, augmented costs, environmental questions, and technological change, enterprises turn towards nearshoring and reshoring for their strategic reinvention. While these two terms are often mistaken for one another, they refer to different practices enabling businesses to reconsider where and how they source and manufacture goods. Understanding Nearshoring and Reshoring Nearshoring refers to transferring business functions like manufacturing to a country next door or relatively close in the same time zone with the home market. For instance: From the USA to Mexico or Central America. This enables reductions in shipping times, lowers costs of logistics, and facilitates clear communication. However, reshoring refers to the manufacturing and supply chain functions returning back to the home country of the company. Some companies beginning to rethink their operations relative to a return move of production back to the original site have traditionally opted for offshore manufacturing. These include going with rising offshore labor costs; growing importance of and desire to control over production processes; and the domestic economy. Near- and reshoring have become significant, but the difference between them is whether production is transferred to another neighboring country or back to the home country. The big change in nearshoring again refers to nearshoring within an up in the air time-space dimension. Nearshoring refers to the practice of relocating business operations, such as manufacturing, to a nearby country, typically one that shares geographical proximity or a similar time zone with the company’s home market. For instance, a company in the United States might shift production to Mexico or Central America. The primary advantages of nearshoring include reduced shipping times, lower logistics costs, and easier communication due to proximity. Reshoring, on the other hand, involves bringing production and supply chain functions back to the company’s home country. Companies that were once reliant on offshore manufacturing are finding it more feasible to shift production back to their original location. This trend is fueled by a variety of factors, including rising labor costs abroad, the need for greater control over production processes, and the desire to bolster domestic economies. While both nearshoring and reshoring are gaining traction, the key difference lies in whether the production is relocated to a neighboring country or returned to the home country. The COVID19 pandemic was a significant catalyst for rethinking global supply chains. The disruption caused by factory shutdowns, transportation bottlenecks, and the unpredictable nature of global trade prompted businesses to consider the vulnerabilities of distant supply chains. Companies found that long and complex supply chains were prone to risk, especially when geopolitical tensions or global

The only supply chain registration you need

Unrivaled context behind every news and article for free.

Anamika Mishra

Anamika Mishra